TOPIC 3 - FINANCE

Financial Management Processes

• planning and implementing – financial needs, budgets, record systems, financial risks, financial controls

– debt and equity financing – advantages and disadvantages of each

– matching the terms and source of finance to business purpose

• monitoring and controlling – cash flow statement, income statement, balance sheet

• financial ratios

– liquidity – current ratio (current assets ÷ current liabilities)

– gearing – debt to equity ratio (total liabilities ÷ total equity)

– profitability – gross profit ratio (gross profit ÷ sales); net profit ratio (net profit ÷ sales); return on equity ratio (net profit ÷ total equity)

– efficiency – expense ratio (total expenses ÷ sales), accounts receivable turnover ratio (sales ÷ accounts receivable)

– comparative ratio analysis – over different time periods, against standards, with similar businesses

• limitations of financial reports – normalised earnings, capitalising expenses, valuing assets, timing issues, debt repayments, notes to the financial statements

• ethical issues related to financial reports

– debt and equity financing – advantages and disadvantages of each

– matching the terms and source of finance to business purpose

• monitoring and controlling – cash flow statement, income statement, balance sheet

• financial ratios

– liquidity – current ratio (current assets ÷ current liabilities)

– gearing – debt to equity ratio (total liabilities ÷ total equity)

– profitability – gross profit ratio (gross profit ÷ sales); net profit ratio (net profit ÷ sales); return on equity ratio (net profit ÷ total equity)

– efficiency – expense ratio (total expenses ÷ sales), accounts receivable turnover ratio (sales ÷ accounts receivable)

– comparative ratio analysis – over different time periods, against standards, with similar businesses

• limitations of financial reports – normalised earnings, capitalising expenses, valuing assets, timing issues, debt repayments, notes to the financial statements

• ethical issues related to financial reports

Planning and implementing

There are many factors to consider when choosing a source of finance. Tutor2u provides a clear outline of some of these factors. Summarise these into the advantages and disadvantages for debt and equity. Also consider why it would be important to have short-term loans for the purchase of current assets and long-term loans or equity for non-current assets and expansion purposes.

Financial Ratios

Remember the objectives of financial management from the Role of Financial Management? Financial ratios provide the tools for assessing how well a business is reaching those objectives. If the ratios reveal issues with meeting objectives, strategies will need to be put in place which are covered in the next sub-topic of Finance. Very roughly, to link the sections of the syllabus, this is how it works:

OBJECTIVE |

RATIOS |

STRATEGIES |

Profitability |

Profitability Ratios - gross profit ratio (gross profit/sales) - net profit ratio (net profit/sales) - return on equity (net profit/total equity) |

Profitability Management - cost controls (fixed/variable, cost centres, expense minimisation) - revenue controls (marketing objectives) |

Efficiency |

Efficiency Ratios - expense ratio (total expenses/sales) - accounts receivable turnover (sales/accounts receivable) BUT not in syllabus, to calculate average days to be paid (365/accounts receivable turnover) |

Although not obvious in the syllabus, these strategies under other headings can apply: - expense minimisation (profitability management) - distribution of payments, discounts for early payment, factoring (cash flow management) - control of current assets - receivables (working capital management) |

Growth |

No ratios (not covered by syllabus) - increase in sales - increase in market share - increase in retail outlets - increase in geographical areas covered |

|

Liquidity |

Liquidity Ratio - aka the current ratio (current assets/current liabilities) Although it isn't in the syllabus, it is also good to know about working capital, which is the current assets remaining after accounting for payments of current liabilities (working capital = current assets - current liabilities) |

Cash Flow Management - cash flow statements - distribution of payments, discounts for early payment, factoring Working Capital Management - control of current assets (cash, receivables, inventories) - control of current liabilities (payables, loans, overdrafts) - strategies (leasing, sale and lease-back) |

Solvency |

Gearing Ratio - aka the debt-to-equity ratio (total liabilities/total equity) |

In the HSC the gearing ratio is used to help assess the most appropriate source of finance (influences on financial management) |

Only watch up to 2:30 minutes in the following Accounts Receivable Turnover video:

Debt to Equity Ratio (Harvard Business Review)

For the HSC: Debt = Total Liabilities (always)

For the HSC: Debt = Total Liabilities (always)

Limitations of financial reports

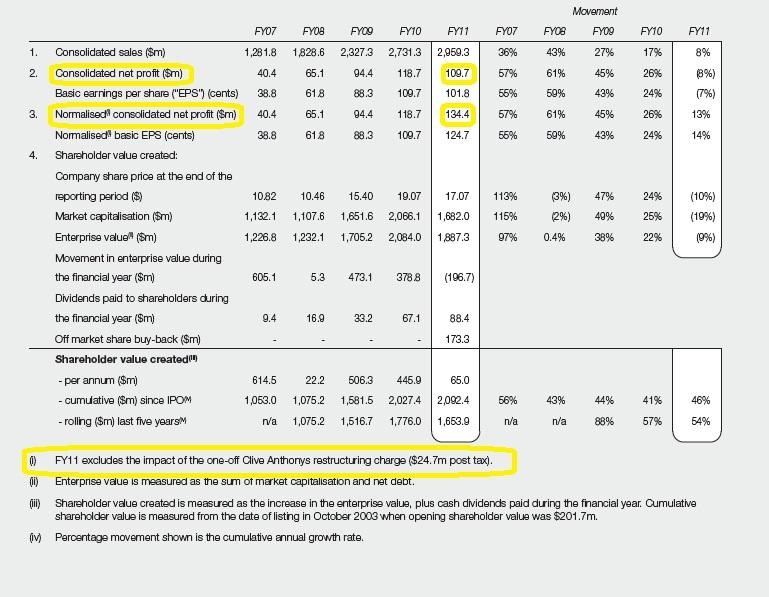

- normalised earnings

- Identify the actual net profit of JB Hi-Fi in 2011.

- Identify the reported normalised earnings of JB Hi-Fi in 2011.

- Explain, in your own words, why JB Hi-Fi would consider the original reported net profit to be a limited reflection of its actual profit.

- capitalising expenses

Read about the various ways companies make the mistake of capitalising expenses as assets (BDO Australia). Explain two different ways companies capitalise expenses in error.

- valuing assets

Identify the advantages and disadvantages of historical cost accounting.

- timing issues (See Cambridge textbook)

- debt repayments (see Chapman textbook)

- notes to the financial statements (look at any Annual Report of a company listed on the ASX)

The 2011 JB Hi-Fi Annual Report page 22:

Ethical issues related to financial reports

READ: What is an 'ethical issue' in financial accounting (Chron) and An ethical dilemma for accountants (The Ethics Centre)

TASK:

1) Explain some of the ethical issues related to financial reports.

2) Find a small group of people with whom to discuss the ethical dilemma.

3) Watch the movie ENRON (not just the promo below) and note all the ethical concerns revealed.

TASK:

1) Explain some of the ethical issues related to financial reports.

2) Find a small group of people with whom to discuss the ethical dilemma.

3) Watch the movie ENRON (not just the promo below) and note all the ethical concerns revealed.